How Portable Mortgages Could Impact Today’s Real Estate Market

How Portable Mortgages Could Impact Today’s Real Estate Market

I still remember the first time I saw someone pass on a perfectly good move because they refused to trade a 3 percent mortgage for today’s rates. It felt like watching a family stuck on a ferry while the rest of the harbor sits empty. The Federal Housing Finance Agency recently put portable mortgages on the table, and that single idea has the potential to unstick the whole market—or make things messier for everyone. I want to explain what a portable mortgage is, why it matters, and what I think the real winners and losers could be.

What is a portable mortgage? 📱

Think of your mortgage like your phone number. When you change carriers, you usually get to keep your number. A portable mortgage would let you do something similar: sell your current house and transfer your existing loan, with the same interest rate and original terms, to the new property you buy. Instead of paying off the old loan and taking a brand new one at today's rates, you carry most of your low-rate balance forward and only finance the difference.

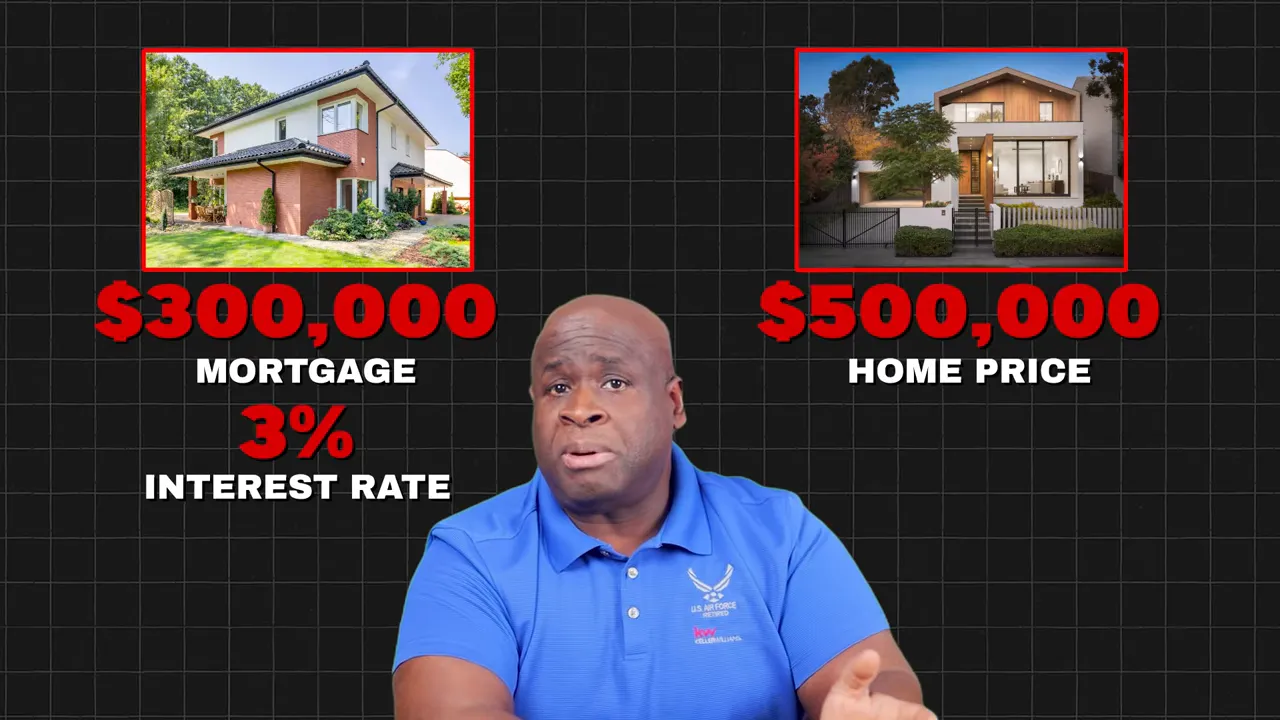

Here’s a concrete example to make it real. Say you have a $300,000 loan at 3 percent on your current house and you buy a $500,000 home. With portability, you could move that $300,000 loan at 3 percent to the new house and only borrow $200,000 at current market rates—let’s say 6.5 percent. The result is a much smaller hike in your monthly payment than if you financed the full $500,000 at 6.5 percent. In plain dollars, that can mean keeping roughly an extra $800 per month in your pocket in this example. That kind of gap changes decisions.

The promise: unlock inventory and help first-time buyers 🪜

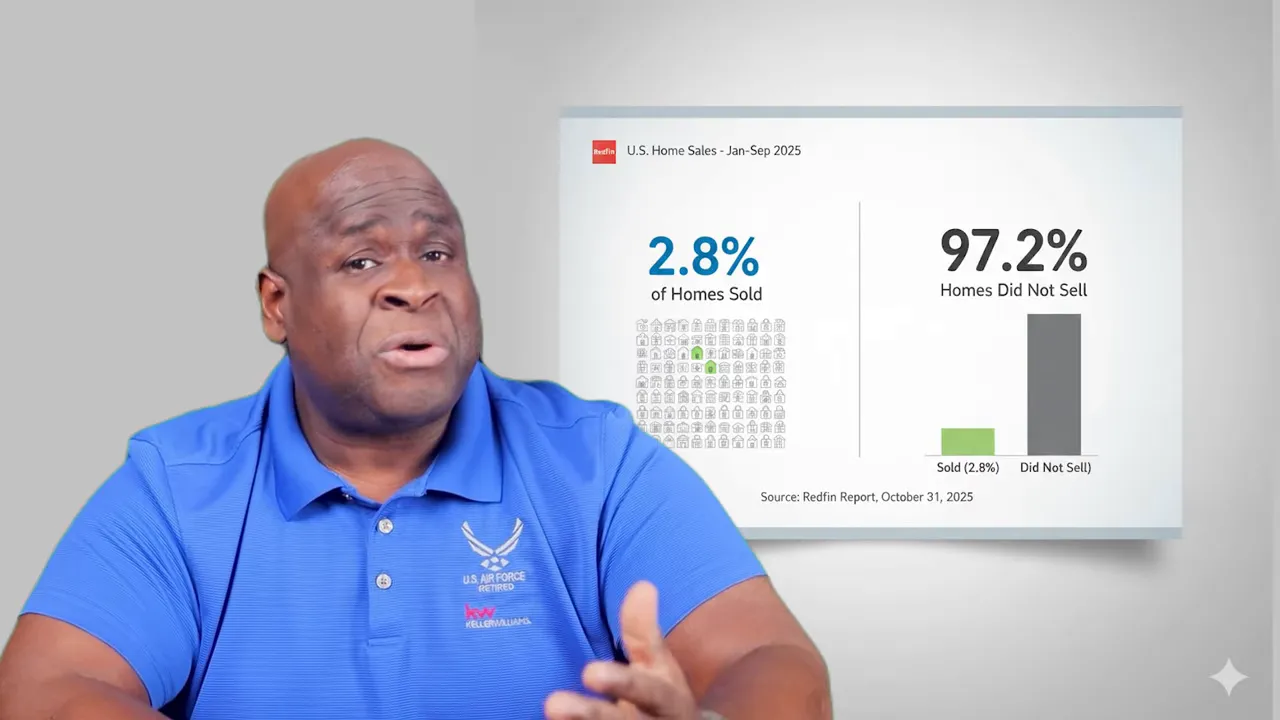

The single biggest housing problem right now isn't mortgage math. It’s that too few homes are for sale. The statistics are brutal: a large share of homes simply aren’t changing hands. Most homeowners refinanced or bought during the low-rate years of 2020–2021 and now feel literally trapped. If a portable mortgage lets those owners move, the market ladder starts working again.

I like using the ladder metaphor. First-time buyers stand below, trying to climb to the first rung. Starter homeowners are on the second rung, and move-up buyers sit higher. When those middle rung owners refuse to move because they'd lose a 3.5 percent mortgage, nobody above or below can move either. Portable mortgages promise to break that logjam by releasing existing starter homes without building a single new house.

The practical effect could be large and immediate. When owners with low rates sell, their starter homes hit the market. First-time buyers and renters get access. Competition softens, bidding wars cool, price volatility reduces, and regional inventory numbers rise. For markets that have been stuck—like many neighborhoods in Las Vegas—this could bring a surge of listings in a way that no subsidy or tax credit can match.

The problem: the mortgage-bond machine isn’t built for portability ⚙️

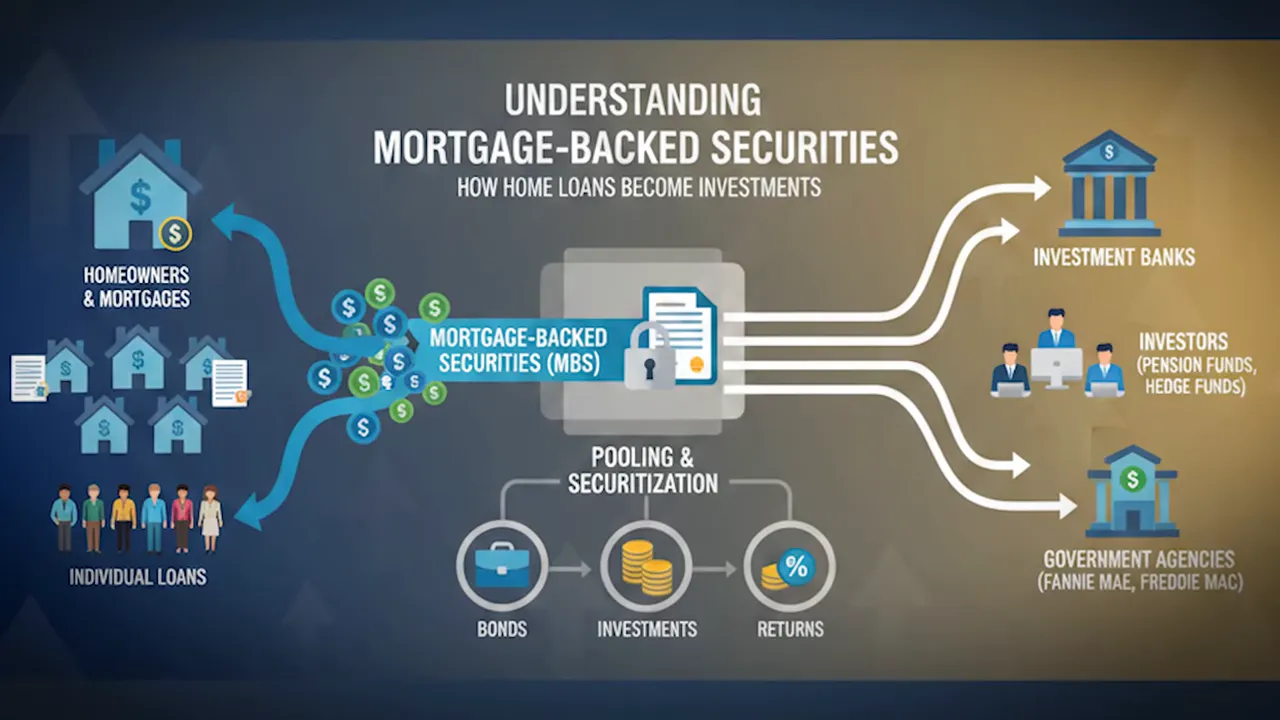

If portability sounds elegant, here’s the blunt follow-up: our mortgage finance architecture was not built for this. Banks originate loans and then sell them into pools called mortgage-backed securities. Investors buy those securities because they can model the cash flows: how much principal will be paid down and when, how many loans will prepay, and how long the pool will last.

Portability changes the math midstream. If a large percentage of loans stop being paid off when a house sells because the loan simply moves to the next property, the collateral backing those securities behaves differently. Investors respond to uncertainty by demanding more compensation. That translates into higher yields on MBS, and that pass-through raises mortgage rates for everyone.

"If mortgages become more portable, the collateral and therefore the risk profile of the entire pool could change midstream." — Jake Kreml, senior economist

There are two channels to watch. First, rates could jump in the short term as investors reprice the added unpredictability. Second, there could be a structural increase in rates if portability materially lengthens loan lives and increases risk on pools. That second effect is the one that keeps policy wonks awake at night: we might help a lucky set of homeowners hold onto low rates only to raise monthly costs for millions of buyers who never had low rates to begin with.

The price: legal complexity and unintended consequences ⚖️

Miles of contracts stand between a mortgage and your mailbox. A mortgage is a lien against a specific property; the address is the collateral. Transferring a loan to a different property is not a small clerical operation. It potentially requires rewriting contracts, updating lien positions, adjusting hazard and title coverage, and re-checking underwriting conditions across millions of files.

Then there’s the behavior problem. Policies designed to protect certain groups sometimes distort markets in ways that hurt others. Examples from rent control to other well-meaning interventions show the risk: protections for some can reduce supply or alter investor incentives and push costs higher for everyone. Portable mortgages have that same trade-off. We might free up homes but also make future borrowing more expensive.

"Portability isn't compatible with the architecture of US mortgage finance." — paraphrase of an industry analysis

That doesn’t mean portability is impossible. Canada and the United Kingdom have forms of portability. The key difference is that their fixed-rate loans tend to be shorter in duration, usually three to five years. Their market already expects renegotiation. The U.S. is different because 30-year fixed loans are the norm, so portability interacts with a very long duration and a deeply entrenched securitization market. That difference makes the U.S. technical challenge much larger.

Policy options on the table and possible compromises 🔧

Washington rarely chooses a binary path when it comes to housing policy. Policymakers and regulators are sniffing around several related ideas that attempt to thread the needle:

- Limited portability: allow portability for a defined portion of the loan or for loans originated under certain criteria.

- Time-limited portability: offer portability only if the move occurs within a specific window or for a limited number of moves.

- Assumable mortgages: let a buyer take over an existing loan but subject to underwriting and a fee; this shifts risk differently because the loan stays attached to the original collateral until formally transferred.

- Government backstops or guarantees: increase explicit support to reassure investors and limit rate upward pressure—but that cost falls on taxpayers and comes with its own political trade-offs.

- Structural reforms to MBS contracting: rewrite investor contracts to explicitly account for portability scenarios and price them into securities from day one.

Each path reduces some pain points while creating others. Limited or time-limited portability would unlock some inventory while capping the influence on MBS risk. Government guarantees reduce investor fear but introduce fiscal exposure. Rewriting securities is elegant but legally and operationally heavy.

How this could play out in Las Vegas and markets like it 🏜️

Las Vegas is a useful lens for seeing what portability would actually do. Inventory is still thin in many segments despite slower turnover. Owners who refinanced in 2020–2021 are a sticky group. If even a fraction of them move because they can keep their rates, neighborhoods filled with starter homes could see a substantial bump in supply.

If portability moves forward in a form that meaningfully reduces the lock-in effect, expect to see an uptick in listings—likely concentrated in spring or summer 2026 after legislation or rule changes are finalized. That could be a real opportunity for first-time buyers who have been priced out or discouraged by low inventory and bidding wars. It could also mean less frantic competition and more time to negotiate, inspect, and plan.

But remember the trade-off. If investors demand higher yields because the MBS model looks riskier, mortgage rates could drift up. That would increase monthly costs for buyers who don’t benefit directly from portability. The net outcome in any local market depends on how portability is designed and how much investor repricing takes place.

What I would watch and what you should do now 🔍

If you are sitting on a mortgage below 4 percent, I would not make any big moving decisions until the policy path clarifies. That doesn’t mean pause planning. Start mapping out the move you would take if portability became a reality: where you’d like to live, what features matter, and what your cost structure would look like under portability scenarios.

If you are actively shopping for a home, track inventory and absorption rates closely in your neighborhoods of interest. A sudden spike in listings could create a buying window where you can avoid bidding wars and negotiate better terms. That might be a better trade-off than a market where interest rates tick up but inventory loosens.

If you advise clients or manage a real estate portfolio, model both scenarios: one where portability unlocks inventory and one where portability raises rates. Prepare playbooks for clients who could be sellers under portability and for buyers who might benefit from expanded inventory.

My view: a cautious optimist with a contingency plan 🧭

I like policies that free up existing supply. Building houses takes time; unlocking homes already built is immediate. Portable mortgages, in theory, solve a real problem. But the devil is in the design details. Done poorly, portability could increase rates and harm affordability for the many who never had low rates to begin with.

My read is that a carefully limited portability program—one that accounts for investor risk, has well-defined legal mechanics, and includes transitional measures—could deliver most of the benefits with a smaller share of the costs. That outcome would require collaboration between regulators, servicers, investors, and Congress. It is neither simple nor guaranteed, but it is worth trying given how frozen the market currently is.

Final practical steps you can take today ✅

- If your rate is below 4 percent: pause any immediate moves until rules are clearer, but plan hypothetically for where you’d move if portability existed.

- If you are buying: keep an eye on inventory trends and be ready to act if listings flood the market next spring or summer.

- If you are advising clients: build models that stress-test both inventory surges and rate increases.

- If you want certainty: talk to a mortgage professional about assumable loans and other programs that already exist and might offer similar benefits with fewer systemic risks.

FAQs 📝

What exactly is a portable mortgage?

A portable mortgage lets a homeowner sell their current property and transfer the existing loan, including its interest rate and original terms, to a new property. The borrower carries the loan balance forward and typically only finances the difference between the new purchase price and the carried balance.

Would portability immediately lower monthly payments for people with low rates?

For those who can transfer most of their low-rate balance, portability can substantially lower the incremental monthly cost of moving versus taking a new loan at current market rates. The exact savings depend on loan balances, the size of the supplemental financing required, and prevailing market rates.

Could portability make mortgage rates higher for everyone else?

Yes. If portability changes the expected life and paydown profile of loans in mortgage-backed pools, investors may demand higher yields to compensate for increased uncertainty. That could raise mortgage rates for other borrowers unless policymakers or market structures offset the impact.

Are there international examples of portability working?

Countries like Canada and the UK have forms of portability. However, their fixed-rate loans are typically much shorter in duration than the 30-year fixed loans common in the U.S., which makes portability easier for them compared with the U.S. market.

What alternatives to portability are policymakers considering?

Ideas include assumable mortgages, 50-year mortgages, limited or time-bound portability, government backstops to reassure investors, and structural changes to how mortgage-backed securities are written to explicitly price portability scenarios.

If I have a great rate, should I sell now or wait?

If your current rate is under 4 percent and your move is motivated primarily by rate concerns, I recommend waiting for clarity on portability rules before making irreversible decisions. However, you can still plan your move, price targets, and contingencies so you’re ready if portability is enacted.

When might portability affect the market?

If regulators or Congress act, a noticeable change in inventory could appear within months to a year after rules are finalized. Some analysts expect any material inventory bump could show up in spring or summer 2026, depending on how quickly implementation occurs.

Will portability help first-time buyers?

Potentially. The single biggest way portability helps first-time buyers is indirect: by enabling starter homeowners to sell, it increases the number of affordable homes on the market. The net benefit to first-time buyers depends on how much inventory is released versus how much mortgage rates change as a result.

Categories

Recent Posts