PCS To Nellis & Creech AFB In 2026: Rent vs Buy In Las Vegas NV — Which Option Saves You More?

PCS To Nellis & Creech AFB In 2026: Rent vs Buy In Las Vegas NV — Which Option Saves You More?

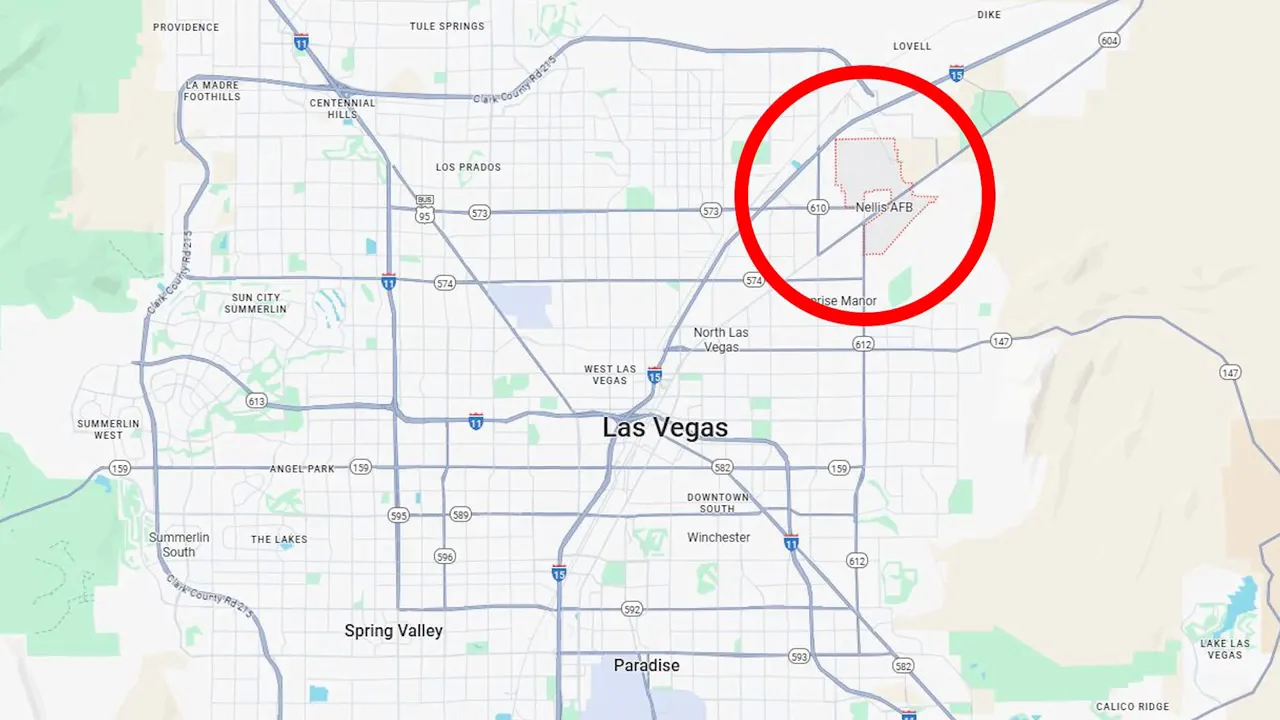

📍 Where Nellis and Creech sit and what that means for your move

I get orders come through and the first practical question is always: where am I going to live? Nellis Air Force Base sits on the northeast side of the Las Vegas Valley just off I-15. Creech Air Force Base is farther out — roughly 35 to 45 miles northwest of the metro area near Indian Springs. Commutes matter: if you live in the main part of Las Vegas, Creech is commonly a 45-minute door-to-gate drive each way. Many Creech families choose the northwest side to cut that down to 35 to 45 minutes depending on the neighborhood.

When you plan your PCS, commute reality shapes neighborhood choice, monthly budget, and lifestyle. That simple fact filters into the rent-versus-buy decision more than most people realize.

📈 Las Vegas market snapshot — advantages for buyers and renters

Right now the local housing market has swung toward a balanced stance and, for practical purposes, leans buyer-friendly. Single-family home medians are hovering around the mid-to-high $400,000s. Inventory is up significantly year-over-year, and months of supply sits near five — a far cry from the under-three-month seller markets many of us lived through.

What this means for you:

- Buyers have leverage: price reductions, seller concessions, and sometimes rate buydowns (especially on new construction).

- Renters also have leverage: landlords are more open to offering upgrades, flexible lease terms, or a free month in some cases.

- Mortgage rates are forecasted to settle in the low sixes or high fives, which is much better than the recent peaks.

Bottom line: whether you rent or buy, you are entering a period with more options and negotiation power than in recent years. The smart move is to analyze your situation rather than rush.

💵 How BAH lines up with Las Vegas housing

Basic Allowance for Housing is generally aligned with market costs in the Las Vegas area. To ballpark BAH with dependents: junior enlisted (E1 range) see numbers near $1,980 while senior enlisted (chiefs) approach $2,700. Officer BAH runs from roughly $2,300 for a 2nd lieutenant up to about $3,600 for senior O-6s (most O-6s choose on-base options).

Concrete examples I use when helping folks run scenarios:

- A staff sergeant with BAH around $2,130 can often qualify for a three-bedroom home with monthly mortgage, taxes, and insurance close to that level using a VA loan. In practice that might allow purchase of a home in the $425,000 to $475,000 range depending on interest rate and HOA presence.

- A captain with BAH near $2,550 could rent a four-bedroom for about $2,400, or buy a median-priced single-family home in the $480,000 range and potentially access homes up to $550,000–$600,000 with low down payment strategies and a VA loan (payments roughly $2,500 to $2,600 monthly depending on final numbers).

Strategy tip: if your mortgage payment is lower than your BAH, you effectively keep the difference tax-free. Over three to four years that gap can compound into a meaningful amount of savings or equity growth.

🎯 VA loan — why it’s a powerful tool for military families

The VA loan changes the calculus for a lot of people moving to Las Vegas. Its advantages are straightforward and impactful:

- Zero down means you can start building equity from day one without draining your savings.

- No private mortgage insurance (PMI) — compared to a conventional loan with under 20% down, this can save $200 to $400 monthly.

- Competitive interest rates — typically a quarter to half a percent better than conventional loans.

- Flexible credit guidelines make homeownership feasible for many who are still rebuilding credit.

That combination — low or no down payment, no PMI, and better rate — is why buying while on active duty can be a strong path to long-term wealth building if your timeline and risk tolerance match.

🧭 Six questions to decide whether to rent or buy

Ask yourself these six practical questions before signing a lease or a purchase contract. Answer honestly and the path becomes clear.

- How long is your assignment? If you expect to be in Las Vegas three years or more, buying becomes more attractive. Shorter than two years strongly favors renting. Three to four years is the sweet spot where many service members can build equity and potentially sell or convert to a rental.

- What is your credit score? A score of 600 or above usually puts you in solid position for a VA loan. If you’re under that, consider renting while you rebuild, although some local landlords may accept military applicants with lower scores because of the commandable nature of military income.

- Do you have an emergency fund? Aim for three to six months of living expenses before buying. Closing costs and move-in essentials can otherwise drain you quickly.

- Are you ready for homeowner responsibilities? If you prefer simplicity and less upkeep, renting is attractive. If you like control over upgrades and long-term value, buying is better.

- What are your long-term goals? If you plan to stay in the military for the long haul, holding property as a rental can make sense. If separation is likely soon, flexibility might matter more.

- Do you want to be a landlord? If not, make sure you can confidently sell when you PCS. If yes, buying can be the first step to a small rental portfolio.

📊 Two practical pitfalls to avoid

Avoid these common mistakes that derail otherwise solid plans:

- Overestimating how much house your BAH will comfortably support — remember to subtract utilities, HOA, maintenance, and insurance when comparing mortgage payment to your BAH.

- Underbudgeting for move-in essentials during the first 60–90 days — new furniture, deposits, repairs, and other upfront costs can spike your cash needs. Factor them in before you commit.

🧮 Real-world examples: staff sergeant vs captain (numbers you can use)

I run these scenarios a lot because they’re practical and representative. The numbers below are approximations meant to show the interplay of BAH, mortgage payments, and buying power. Your exact numbers will vary with interest rate, local taxes, HOA fees, and loan packaging.

Staff sergeant example

- BAH (with dependents): ≈ $2,130

- Possible mortgage payment (principal, interest, taxes, insurance): ≈ $2,100–$2,200

- House price range achievable with VA loan: roughly $425,000–$475,000

- Monthly net advantage if mortgage < BAH: keeps the difference tax-free

Scenario logic: if the mortgage payment sits slightly below BAH, you pocket the difference. Over three to four years you build equity and possibly benefit from modest appreciation. If you need to PCS sooner, you can either sell (current inventory means it may take months but pricing is fair) or convert to a rental if you plan to return or want passive income.

Captain example

- BAH (with dependents): ≈ $2,550

- Typical rent for a four-bedroom in Las Vegas: ≈ $2,400

- Buying power with VA loan and favorable rates: median home at $480,000 up to $550,000–$600,000 depending on final loan terms

- Estimated monthly mortgage for a $550,000 purchase (with taxes and insurance): ≈ $2,500–$2,600

Scenario logic: at these levels the choice becomes lifestyle-driven. Do you prefer stability and building equity despite slightly higher monthly outflow compared to rent? Or do you prioritize flexibility and less responsibility by renting? If mortgage payments remain under or close to BAH, buying wins on tax-free cash flow and equity accumulation.

🧾 Negotiation and timing: how to use market conditions to your advantage

We’re in a rare window where both buyers and renters have the upper hand. Use it.

- Buyers should ask sellers for credits, closing cost help, or rate buydowns. New construction often offers attractive temporary rate buydowns.

- Renters should negotiate lease length, free months, or modest upgrades. Landlords are more likely to work with quality tenants now than they were at market peak.

- Don’t rush. Take time to run a clear budget that includes utilities, HOA, maintenance, and a move-in fund of three months of expenses.

🧾 Practical checklist to run your own rent-versus-buy scenario

Use these quick action steps to make a confident decision:

- Estimate BAH for your rank and dependency status.

- Get preapproved with a lender and request a VA preapproval if eligible.

- Factor in all monthly housing costs: mortgage, taxes, insurance, HOA, utilities, maintenance.

- Compare to realistic rent in your target neighborhood and include renter costs like deposits and renter’s insurance.

- Ensure three to six months emergency fund remains after closing deposits or rental move-ins.

- Decide based on timeline: buy if 3+ years, rent if under 2 years, and weigh personal goals if 2–3 years.

🎬

❓ Frequently asked questions

When does buying make more sense than renting for a PCS to Las Vegas?

Buying tends to make sense when your assignment is three years or longer, you have sufficient emergency savings, and your mortgage payment (including taxes and insurance) is comfortably below or similar to your BAH. If you plan to stay in the area long term or want to hold a property as a rental, buying becomes more attractive.

How much house can my BAH realistically support?

BAH gives you buying power, but you must account for taxes, insurance, HOA, and utilities. A simple rule is to use a lender’s preapproval number as a starting point, then subtract estimated taxes and insurance to see monthly PITI. If that number is lower than your BAH by a comfortable margin, you’re in good shape.

Is the VA loan always the best choice?

For eligible borrowers, the VA loan is powerful because of zero down and no PMI. It is often the best starting option, but every buyer should compare interest rates, lender fees, and seller incentives. In certain cases, conventional financing might make sense if you can put a large down payment or seek different loan features.

What are common mistakes military families make during a PCS housing decision?

Common mistakes include overestimating how much house BAH will support, underfunding a move-in emergency reserve, and rushing into purchase without comparing rent alternatives and negotiation potential. Also, failing to account for commute time can lead to lifestyle regrets later.

If I buy and then PCS again quickly, can I sell easily in this market?

Current inventory is higher than in recent years, so selling may take longer than in a hot seller market — often multiple months. That said, pricing competitively and working with a local agent can help. Converting the property to a rental is another option if selling is not desirable immediately.

✅ Final thought

Your move to Nellis or Creech can be a financial win if you lean into the data and plan. BAH plus a VA loan gives a unique opportunity to build tax-free cash flow and equity while serving. But timing, credit, emergency savings, and willingness to manage a property matter just as much as the numbers. Run the six-question checklist, get a VA preapproval if you qualify, and negotiate hard whether you rent or buy. That’s how you keep tens of thousands in your pocket instead of leaving them on the table.

Categories

Recent Posts