Is the 50 Year Mortgage a Lifeline or a Total Money Trap for Homebuyers | Carpool Confessions

Is the 50 Year Mortgage a Lifeline or a Total Money Trap for Homebuyers | Carpool Confessions

🔍 What the 50-year mortgage actually means

I’ve been chewing on this 50-year mortgage idea that’s been floating around and wanted to break it down plainly. On the surface it’s simple: you stretch the loan from 30 or 40 years to 50 years and your monthly payment goes down. That’s obvious. The catch is what you don’t see as quickly — the longer term amplifies how much interest you pay over the life of the loan.

Interest rates climbed hard over the last few years. When rates were under 3 percent, lots of buyers piled in and home prices surged. Now the rates are much higher, houses are sitting longer on the market in many places, and a million homeowners are flirting with negative equity. So policymakers are looking for tools to improve affordability. One proposed tool is a 50-year mortgage. It’s attractive because of a lower payment, but the tradeoffs are real and large.

🧮 A raw numbers example I ran (because the math tells the story)

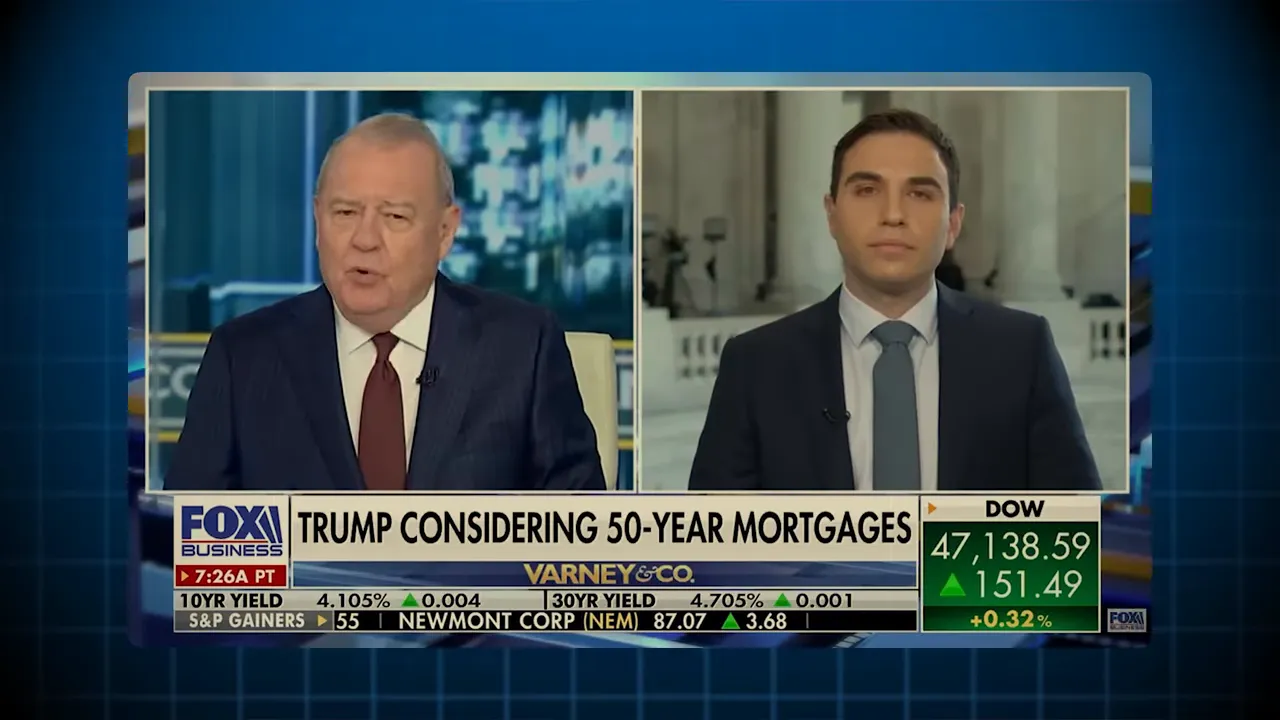

I like to keep examples straightforward so the tradeoffs are visible. Here’s the scenario I used:

- House price: $400,000

- Loan type: conventional (typical buyers don’t put 20 percent down)

- Down payment: 5% for conventional; FHA would typically be 3.5%

- Interest rate baseline: 6.25% (this is a round, nationwideish number for the example)

- I focused on principal and interest only — taxes, insurance, HOA, and PMI would change monthly totals but not the direct comparison

Using that baseline, here’s what I found.

30-year conventional at 6.25%

Your monthly principal and interest payment comes to about $2,340.

50-year at 6.25%

The monthly payment drops to roughly $2,070, so you’re saving around $270 per month. That sounds good — until you look at the total cost.

Over 30 years you end up paying a little over $800,000 in principal and interest. Over 50 years at the same rate, you’re roughly paying about $1.2 million. That’s about $400,000 more in interest. That extra interest could buy another house in many markets.

<img src="https://firebasestorage.googleapis.com/v0/b/videotoblog-35c6e.appspot.com/o/%2Fusers%2FjWHHxVz9lPhTWobyNsW7yxwtk3V2%2Fblogs%2FQXRaM2iDtr8QoJ7CzVuX%2Fscreenshots%2F5e7bb0de-c8b3-4cdb-9ba8-dbfc034b5b0f.webp?alt=media&token=f4cc867e-b738-4afa-898d-7d296ae9fff4" data-caption-id="b410a82" alt="Slide summarizing the 50-year mortgage: " loan="" amount:="" $400,000",="" "interest="" rate:="" 6.25%",="" "mo.="" payment:="" $2,070",="" "total="" paid:="" $1,200,000"="" on="" a="" blue="" grid="" background."="" data-slug="50-year-total-paid-1-2-million" data-caption-1="Talking through the mortgage tradeoffs from the driver seat." data-slug-1="host-in-car-explaining-50-year-mortgage" data-caption-2="The 50‑year monthly payment called out: $2,070/mo." $2,070="" mo="" (50-year)"="" in="" large="" red="" and="" white="" text."="" data-slug-2="2070-month-50-year-payment" data-caption-3="Side‑by‑side monthly payments for the two terms." "-="" $2,340="" (30-year)"="" comparing="" monthly="" payments."="" data-slug-3="compare-50-vs-30-monthly-payments" data-caption-4="The headline: about $270 per month in apparent savings." $270="" savings"="" banner."="" data-slug-4="270-month-savings-50-year" data-caption-5="Another clear visual of the $270/month difference used in the example." (50-year)="" -="" (30-year)="$270/MO" savings"."="" data-slug-5="270-month-difference-visual" data-caption-6="The base assumptions for the 50‑year scenario: loan, rate, payment." 50-year="" mortgage"="" with="" "loan="" $2,070"="" data-slug-6="50-year-loan-400k-6-25-percent" data-caption-7="The eye‑opener: the 50‑year example costs about $1.2M over the life of the loan." data-slug-7="50-year-total-paid-1-2-million" width="100%" style="object-fit: cover;">

⚠️ The realistic kicker: lenders price rate for term

A critical point a lot of people miss: lenders don’t typically give identical interest rates for longer terms. Longer terms usually mean higher rates because the lender takes on rate and credit risk for a longer period. In practice a 50-year rate will likely be higher than the 30-year rate.

Using a slightly more realistic number — say 6.5% for a 50-year loan — changes the math again. At 6.5% the monthly payment for the 50-year drops to about $2,142. That’s only around $200 less per month compared with the 30-year at 6.25 percent. But the lifetime cost balloons to around $1.385 million — almost $600,000 more than what you’d pay under the 30-year scenario.

💡 Why a lower monthly payment can be a false bargain

Three things happen when you extend a mortgage to 50 years:

- You pay less each month, which may help with immediate affordability.

- Because the principal is amortized much more slowly, your loan balance stays higher for longer — you build equity slowly.

- Total interest paid over the life of the loan skyrockets, often adding hundreds of thousands of dollars to your lifetime housing cost.

That’s the math. You trade near-term cashflow relief for very expensive long-term financing. If your plan is to stay in the house just a few years, the smaller monthly payment might make sense for interim affordability. If you plan to keep the house for decades, you’re paying a large premium for that monthly relief.

📉 A better lever to pull: get the rate down, not just stretch the term

If monthly payment is the problem, interest rate moves the needle far more than extending term. Here’s an eye-opening comparison: if you can lower the interest rate by one percentage point — from 6.25% to 5.25% — that change can produce a monthly payment that beats the 50-year option and still leaves you with a much lower lifetime cost.

It’s not always easy to drop your rate by a full point, but there are realistic ways to get lower rates:

- Shop lenders and compare written rate quotes. Small differences in rate mean large differences over time.

- Look for lender credits, buy-downs, or builder incentives that effectively reduce the rate for a period.

- Improve your down payment or credit profile to qualify for better pricing.

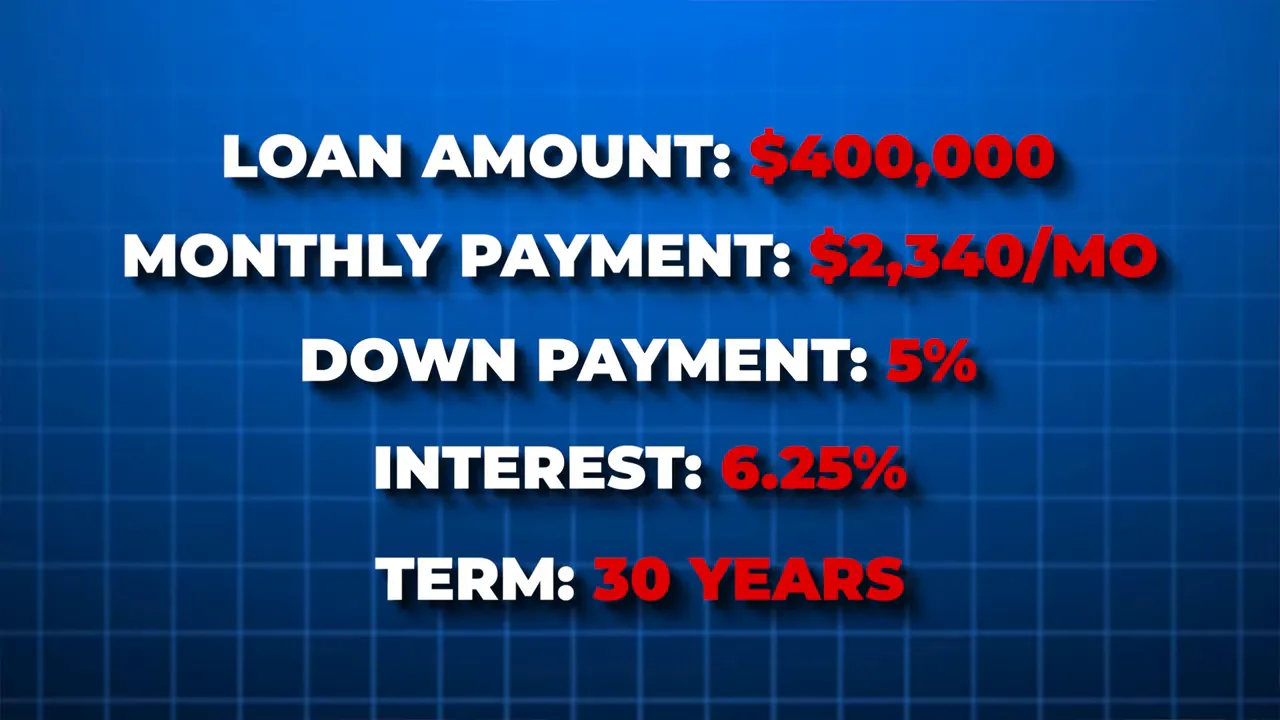

🏗️ Builders and creative financing — real-world alternatives I’ve seen

I’ve been out in new communities and both builders and lenders are pushing programs to make monthly payments attractive without resorting to multi-decade loans. A few examples I encountered:

- Temporary low initial rates on purchase programs — for example, adjustable programs that give you a low fixed rate for the first several years (one example was 3.5% for the first seven years on a 75/5 style structure). That can drastically reduce payments initially.

- Builder incentives that include reduced interest rates for VA and FHA buyers (one community was offering 4.99% for VA/FHA and 5.25% for conventional loans).

- Flex cash incentives — I saw a builder offering $30,000 in flex cash, which can be used for closing costs, down payment help, or other buyer needs. That money often beats the long-term cost of stretched financing.

- Down payment assistance in the form of forgivable loans — for FHA buyers some programs cover the 3.5% down payment with a forgivable loan that disappears after a few years of occupancy.

These programs can make homeownership attainable without locking into an extraordinarily long and expensive loan. They aren’t perfect and some carry their own tax or recapture rules, but they deserve evaluation against the 50-year option.

🧭 How to decide if a 50-year mortgage is right for you

I don’t believe the 50-year mortgage is universally “bad” or a universal “fix.” It’s a tool. Whether it’s useful depends on your goals, time horizon, and alternatives. Here is how I suggest sizing the decision up:

- Calculate the monthly payment and total cost using conservative interest-rate estimates for both 30- and 50-year terms. Lenders will price the longer term differently — assume it will be higher.

- Decide your timeline. If you plan to move or refinance within a handful of years, a lower payment could help you qualify and survive short-term shocks. If you expect to stay 20–30 years, the total interest paid matters a lot more.

- Compare alternatives that reduce payment without massively extending term: rate buy-downs, builder incentives, down payment assistance, or shorter-term ARMs with low initial fixed periods.

- Talk to multiple lenders and get illustrations showing cumulative interest paid at different breakpoints (5, 10, 30 years). Numbers tell the true story.

📌 Quick comparison summary

- Monthly savings with 50-year vs 30-year: modest (often a few hundred dollars)

- Total cost over life of loan: substantially higher on a 50-year — often hundreds of thousands more

- Equity buildup: much slower on a 50-year loan

- When it can make sense: short-term affordability needs, planned move/refinance, or when alternatives aren’t available

- When to be cautious: if you plan to stay long-term and can access rate reductions or incentives that reduce monthly payment without a huge life-of-loan cost

<img src="https://firebasestorage.googleapis.com/v0/b/videotoblog-35c6e.appspot.com/o/%2Fusers%2FjWHHxVz9lPhTWobyNsW7yxwtk3V2%2Fblogs%2FQXRaM2iDtr8QoJ7CzVuX%2Fscreenshots%2F470e549e-9fe1-48f0-bd20-cf7c2f01dd24.webp?alt=media&token=96ef36d3-1ec4-44f0-8f85-24f916f3a0c5" data-caption-id="be8279c" alt="Freddie Mac Primary Mortgage Market Survey chart showing 30‑year and 15‑year rates over time (30Y ~6.24%, 15Y ~5.49%)." data-slug="freddie-mac-mortgage-rate-trend-30yr-6-24-15yr-5-49" data-caption-1="Talking through why a 50‑year mortgage can feel tempting in the moment." data-slug-1="host-driving-explaining-mortgage-closeup" data-caption-2="Continuing the carpool conversation — weighing monthly payment versus lifetime cost." data-slug-2="host-in-car-weighing-payment-vs-cost" data-caption-3="A payment callout used in the example: $1,700/mo." $1,700="" mo"="" used="" to="" illustrate="" a="" monthly="" payment="" example."="" data-slug-3="payment-callout-1700-per-month" data-caption-4="Walking through the numbers — why term and rate both matter." data-slug-4="host-explaining-term-and-rate" data-caption-5="One more in-car angle while I explain tradeoffs and alternatives." data-slug-5="in-car-discussion-mortgage-tradeoffs" data-caption-6="Freddie Mac rate trends — a reminder that rate moves matter as much as term." data-slug-6="freddie-mac-mortgage-rate-trend-30yr-6-24-15yr-5-49" data-caption-7="30‑year fixed rate history — peaks and declines that change lifetime cost." data-slug-7="30-year-fixed-mortgage-rates-chart-peak-2023" width="100%" style="object-fit: cover;">

🤝 My practical checklist before you sign anything

When lenders or programs get complicated, use this checklist so you’re making a numbers-based decision:

- Ask for a full amortization schedule for the loan you’re being offered and for the comparable 30-year loan.

- Compare total interest paid, not just monthly payments.

- Confirm whether the 50-year rate is fixed or adjustable and what the worst-case payment would be if rates rise.

- Ask whether any incentives that reduce rates are temporary and what happens when the temporary period ends.

- Explore down payment assistance and builder flex cash as alternatives to stretching the loan term.

🎯 Bottom line — is a 50-year mortgage a lifeline or a trap?

It can be both, depending on how you use it. If your priority is short-term affordability and you plan to move or refinance in a few years, a 50-year mortgage could be a tool to bridge a gap. If you’re thinking long-term ownership, that small monthly relief often translates into staggeringly large interest costs down the road.

I ran the math. The monthly savings are real but relatively small. The lifetime cost difference is enormous. So I always urge homeowners to look beyond the monthly payment and focus on lifetime dollars, alternative incentives, and realistic rate quotes from multiple lenders.

If you’re working through numbers and want a straightforward way to compare scenarios, get written illustrations from lenders and insist on amortization schedules. That’s where the truth is hiding.

I’m not saying “never” — I’m saying do the math, ask hard questions, and compare alternatives before committing to a multi-decade tradeoff.

❓Frequently asked questions

Does a 50-year mortgage always lower my monthly payment?

A 50-year mortgage almost always reduces monthly principal and interest versus a 30-year loan at the same rate. However lenders typically charge higher rates for longer terms, so the monthly savings may be smaller than expected once you use a realistic 50-year rate.

Will I pay more interest over the life of a 50-year mortgage?

Yes. Extending amortization to 50 years drastically increases total interest paid. Even if your monthly payment is only a couple hundred dollars lower, you can end up paying hundreds of thousands more in interest over the life of the loan.

Is a 50-year mortgage ever a smart move?

It can be useful if you need short-term affordability, plan to move or refinance in a few years, and you can’t access better options. For long-term owners it’s typically a poor tradeoff compared to options that reduce the rate or provide down payment assistance.

What alternatives should I consider instead of a 50-year mortgage?

Look at rate buy-downs, builder incentives, forgivable down payment assistance, temporary low-rate programs, and shopping lenders for better pricing. Sometimes a combination of lower initial rate and builder flex cash reduces monthly payment without a large lifetime cost.

How do I compare loan offers properly?

Ask for amortization schedules and total interest paid at multiple time horizons. Compare the fully amortized 30-year cost to any 50-year proposal with realistic rates. Factor in closing costs, PMI, and whether teaser rates are temporary or permanent.

Categories

Recent Posts