Never Buy These Homes in Las Vegas If You Want to Avoid Expensive Problems

Never Buy These Homes in Las Vegas If You Want to Avoid Expensive Problems

Buying a home in Las Vegas is exciting, especially if you are relocating or PCSing, but I have seen the same avoidable money pits show up again and again. One bad storm, one surprise power bill, or one noisy location can erase your down payment and turn what should be a joyful move into a long regret. I wrote this guide to give you objective buyer filters you can run quickly: foundations and soils, flood risk, safety, energy, water usage, investor concentration, and noise. Run these checks before you fall in love so you can buy with confidence and avoid drama.

🔍 How I Filter Homes — The 7 Traps to Avoid

I use the same mental checklist for every buyer I work with. If a house trips any of these traps and the problem cannot be confirmed as fixed by paperwork or a licensed engineer, I walk away or add hard contingencies. The seven traps are:

- Foundations and soils

- Flood pockets and low-lying lots

- Block-by-block safety signals

- Energy money pits that skyrocket summer bills

- Water hogs because water is getting more expensive

- Investor-heavy streets that hurt long-term resale

- Noisy or problematic infrastructure locations

🏗️ Foundations and Soils: What to Spot at a Showing

Vegas soils are unique and can shift. You often get layers of sandy soils over a hard caliche layer. Add monsoonal rains or poorly managed drainage and you can get slab movement, undermined corners, and cracking that is easy to miss on a quick walkthrough. Problems are not always obvious at a showing, but there are fast red flags you can spot right away.

- Stair step cracks in stucco or in the exterior near corners

- Doors that rub, won’t latch, or windows that have become misaligned

- Negative grading where the ground slopes toward the house

- Water staining at the base of exterior walls

- Missing or filled expansion joints on slab edges

If you see any of these signs, do not rely solely on a general home inspector. I require a licensed structural engineer to review and sign off on the foundation. This is separate from the standard inspection and can be the difference between a $500 repair and a $12,000 to $15,000 repair.

Case study: I worked with a relocating family who fell for a gorgeous single story with subtle drywall cracks. The structural engineer's findings showed grading was pushing water toward two corners and undermined the slab support. The seller agreed to regrade the lot, extend downspouts, and epoxy inject key cracks before closing — about a $12,000 to $15,000 fix documented with invoices and a warranty. Without that engineering report and receipts, the family would have closed into a latent defect and lived with it for years.

What to require from the seller or expect as contingencies:

- Licensed structural engineer sign-off for any foundation movement

- Documentation for previous foundation repairs, with warranties and invoices

- Visible drainage improvements like downspout extensions 6 to 10 feet from the slab

- Positive grading away from the structure and intact expansion joints

🌊 Flood Risk: Don’t Skip FEMA and County Maps

We live in a desert, but floods happen. There are pockets on the east side, parts of Henderson, and low-lying areas near washes and retention basins that fall into FEMA’s special flood hazard areas. Flood risk is a deal maker or breaker because flood insurance and water intrusion claims can drastically change your cost of ownership and resale appeal.

Quick address test you can run right now:

- Enter the address into FEMA flood maps and Clark County Regional Flood District maps.

- Look for nearby washes, deep gutters, or retention basins on the parcel map.

- Ask for a five-year history of water intrusion, roof repairs, or insurance claims.

- If any flood risk shows, price flood insurance before you write the offer and ask the seller for documented mitigations.

Hidden costs from a single flood event can include mold remediation, warped floors, electrical repairs, lender-required flood insurance, and resale stigma. Prefer higher elevation lots that are outside mapped flood zones or have documented mitigation like raised pads, flood vents, or a LOMA letter removing the structure from the high-risk zone.

🚨 Safety Research: Block-by-Block Matters

Crime and safety are block-by-block and time-of-day sensitive. I never recommend buyers rely on neighborhood anecdotes or a single drive-by. Instead, use official tools and a pattern-based approach to research safety.

Steps I use and recommend:

- Use official crime mapping tools for Metro, North Las Vegas, and Henderson and compare a one-mile radius over 6 to 12 months, not a week.

- Visit the area at multiple times: weekday afternoons, early mornings, weekend nights.

- Get insurance quotes for the address to see if premiums are elevated.

- Observe clues in person: street lighting, maintained yards, neighbors outside after dark, visible cameras, and general upkeep.

Set your comfort level and stick to it. If your research does not meet your comfort level, keep shopping. There are always other houses available and no purchase is worth compromising safety peace of mind.

❄️ Energy Money Pits: How to Avoid $400 to $500 Summer Bills

This is where many buyers, especially folks relocating from temperate climates, get blindsided. Las Vegas summers will make an inefficient home into a constantly running AC machine. I regularly see summer total bills that spike far higher than expected because of a few common culprits.

Common culprits that create massive cooling bills:

- Thin attic insulation or uneven coverage

- Single pane windows in older homes

- Large west or south facing glass without shading

- Undersized or tired HVAC units that run nonstop

- No shading, deep eaves, or trees on hot exposures

Thirty minutes of due diligence will save you thousands. Ask the seller or listing agent for 12 months of electrical bills. The summer spikes will show instantly. The Nevada utility company will often release usage history for the meter to your authorization so request it during your due diligence period.

During inspection, make the inspector photograph and measure attic insulation. Aim for R38 or higher and ensure even coverage. Verify the HVAC's age and tonnage relative to the square footage. A mismatched HVAC will run non-stop and drive up bills.

Do a quick bill walkthrough when you review the utility invoices. Look for total kilowatt hours in July or August, any demand charges, and average daily usage. Then match fixes to outcomes. Jumping from an old 10 SEER unit to a modern high SEER unit and adding R38 attic insulation typically cuts peak summer kilowatt hours noticeably—your AC cycles off and the house stabilizes.

Other efficiency wins:

- Dual pane windows and low-e glass

- Shade structures, deep eaves, and west-facing awnings

- Smart thermostats with scheduling and zoning

- Solar panels — but treat solar as its own category: check whether panels are leased, owned, or on a PPA and get a solar inspection

To put this in perspective: ask yourself if you would rather spend $8,000 to $10,000 now to upgrade insulation and HVAC or pay an extra $250 each summer month for five years. Both options have a cost, but upgrades improve comfort and resale value while recurring high bills are ongoing pain that buyers often overlook.

💧 Water Hogs: Big Lawns Are Expensive

Water is increasingly expensive and tightly regulated. Large front lawns, daytime sprinklers in summer, overspray onto sidewalks, and old spray irrigation systems are red flags. Many local municipalities have strict watering schedules and will ticket or fine overwatering. If you do not want a weekend chore or a high monthly water bill, look for alternatives.

What to watch for:

- Large expanses of turf without drip irrigation for planting beds

- Old popup spray heads with overspray on sidewalks

- Daytime summer watering that will likely be out of compliance

What I recommend instead:

- Zeroscape landscaping with drip irrigation for plants

- Smart irrigation controllers that adapt to weather

- Drought tolerant plantings and smaller turf pockets or artificial turf where desired

If you love a green lawn, consider small artificial turf zones for aesthetics while eliminating the water hog. If you absolutely must have real grass, factor higher water bills and maintenance into your budget.

🏘️ Investor-Heavy Streets: How Rentals Impact Resale

Streets dominated by investors and corporate rentals tend to feel transient. High investor concentration can soften appreciation, make yards inconsistent, and increase the frequency of move-ins and move-outs that drive down curb appeal.

How to identify investor-heavy streets:

- Check the county assessor for many properties owned by LLCs or trusts on the same block

- Look for managed rental signs and frequent weekday or weekend move-ins

- Observe inconsistent yard care and a lack of pride of ownership

What I prefer for long-term growth and resale:

- Neighborhoods with visible pride of ownership: maintained yards, people outside on weekends, and consistent upkeep

- Higher owner-occupancy ratios and HOAs with rental caps (if applicable)

- Avoid areas with a high density of short-term rentals such as Airbnb when you want a quiet community

During due diligence, ask your agent to pull owner occupancy ratios and rental caps. Some HOAs restrict rentals or have strict short-term rental policies — that can be a huge advantage to long-term appreciation.

✈️ Noise and Infrastructure: The Price of a Perfect House in the Wrong Spot

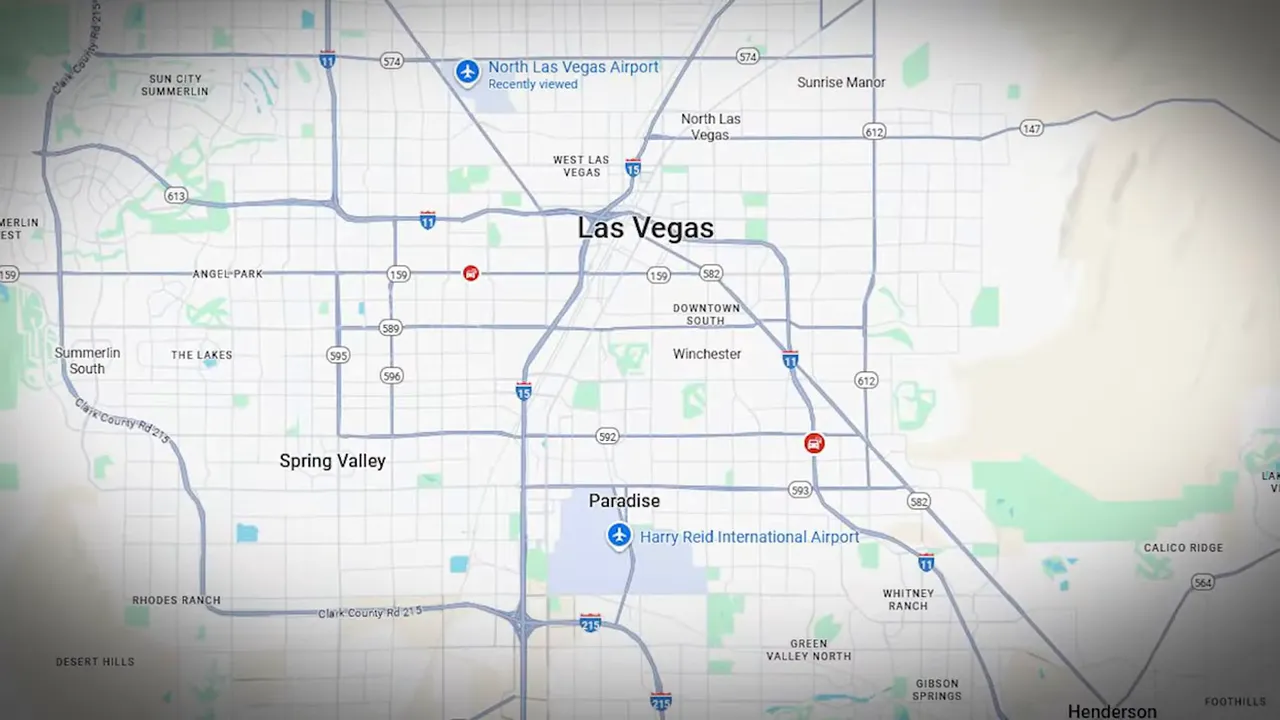

The perfect house in the wrong spot equals daily regret. In Las Vegas, noise sources are many: major airports including Harry Reid International, North Las Vegas, Henderson, active military air bases, freeway ramps like the I-15 and the 215, 24-hour commercial edges, logistics yards, and late-night venues. Jet, helicopter, and low-altitude flight paths are a real factor.

Practical onsite noise test:

- Visit nights and weekends — not just a weekday afternoon.

- Stand in the backyard for five minutes with a phone call in hand. If you cannot finish a sentence without asking the person to repeat themselves, keep shopping.

- Listen for freeway noise, persistent truck activity, or music from nearby venues.

Map-based sanity checks I use:

- Airport noise contour maps to see general patterns of exposure

- Live flight trackers showing current approach and departure patterns — these help for Harry Reid but less so for smaller fields

- City and county planning maps for any approved or proposed highway or logistics projects near the address

If two of three sources say busy or noisy, expect the home’s noise profile to remain or get worse. Noise not only affects day-to-day living but also resale value and buyer pool later on.

✅ What to Buy Instead — A Simple Buyer Filter

Here’s my short list of what to favor when you are shopping in Las Vegas or similar desert climates:

- Well drained lots outside mapped flood zones or with documented mitigation

- Homes with efficient envelopes: R38 plus attic insulation, sealed ducts, dual pane windows, and a properly sized modern HVAC

- Zeroscaped or drip-irrigated yards with smart controllers if you want low water use

- Streets with high owner occupancy and visible pride of ownership rather than investor-heavy blocks

- Interior lots away from major flight paths, freeways, logistics yards, or late-night entertainment venues

Those filters will protect you from the biggest surprise costs and make your home more comfortable to live in and easier to resell.

🛠️ Checklist: Questions to Ask and Documents to Request

Before you fall in love, ask for the following as standard parts of your offer or due diligence:

- 12 months of electric bills for the meter and usage history

- Attic insulation photo and R-value from the inspector

- HVAC age, tonnage, and maintenance records

- Any structural engineer reports and warranties for foundation work

- Flood history and five-year water intrusion or roof claims

- Solar contract documents and inspection if panels are present (leased panels create complications)

- HOA documents that state rental caps and short-term rental rules

- County assessor owner names for the block to identify investor concentration

Get these documents in writing and review them with professionals when necessary. Engineering letters, invoice-backed repairs, and warranty coverage matter. They convert unknown risk into documented risk you can price or negotiate around.

📌 Quick Wins I Use With Every Buyer

When I work with a buyer I always do a few quick wins that take little time but return a lot of value:

- Run the address through FEMA and local flood district maps

- Request the last 12 months of utility usage and do a bill walkthrough

- Drive the block at night and on a weekend morning to get a feel for noise and activity

- Check the county assessor for LLC owners and clustered investor names

- Insist on a structural engineer sign-off if there are any visible foundation red flags

📄 Free Relocation Tools and Next Steps

If you are relocating or PCSing, a checklist tailored to Las Vegas is invaluable. I keep a short relocation checklist and address check toolkit that helps buyers run these filters quickly for any property. If you want help with an address-specific check, include the parcel when you reach out and I’ll run the maps for you. Even if you are months away from buying, run through the checks above so you are not surprised when you get here.

What are the most common foundation warning signs to look for during a showing?

Stair step cracks in stucco, doors or windows that rub or do not latch, and negative grading where the ground slopes toward the house. Water staining at the base of walls and missing expansion joints are also red flags. If you see any of these, require a licensed structural engineer’s assessment separate from a general home inspection.

How do I check flood risk for a specific address?

Use the FEMA flood maps and the Clark County Regional Flood District maps, and check parcel-level maps for nearby washes, retention basins, and deep gutters. Ask the seller for five years of water intrusion history or insurance claims. If a property is in a flood zone, price flood insurance into your ownership costs and look for documented mitigation or a LOMA letter.

What quick steps reveal if a home will have high summer energy bills?

Request the last 12 months of electric bills and inspect the July and August usage. Ask the inspector to photograph and measure attic insulation and verify the HVAC age and tonnage. Look for single pane windows, large west-facing glass, lack of shade, or a small undersized HVAC. Those are the highest predictors of elevated cooling costs.

How can I tell if a street is investor heavy?

Check the county assessor for multiple properties on the same block owned by LLCs or trusts. Look for frequent weekend move-ins, inconsistent yard care, and a lack of long-term homeowner presence. Ask your agent for owner-occupancy ratios and HOA rental cap rules during due diligence.

What map tools help with noise checks?

Use airport noise contour maps for general patterns, live flight trackers to see current approach and departure paths, and city planning maps to check for approved or proposed highway or logistics projects. Combine mapping with in-person visits at night and on weekends for a full picture.

Is solar always a net benefit?

Solar can reduce bills but it is complex. Check if the system is leased, under a PPA, or owned outright. Ask for a solar inspection and all contract documents. Leased systems can complicate financing and resale, so treat solar as its own category that requires careful due diligence.

If I find red flags, what contingencies should I include in my offer?

Common contingencies include a structural engineer’s approval for foundation issues, satisfactory water intrusion and flood history review, review of 12 months of utility bills, a solar contract review if panels are present, and a buyer approval period for HOA documents and owner occupancy ratios. Attach repair deadlines and verification documentation to any negotiated fixes.

🔚 Final Takeaways

Think twice about homes with foundation and soil red flags unless you have an engineer’s sign-off. Run every address through FEMA and county flood district maps. Research safety with official crime mapping and multi-time visits. Avoid energy money pits by verifying attic insulation, HVAC sizing, windows, and requesting 12 months of electric bills. Watch out for large thirsty lawns and outdated irrigation. Avoid streets dominated by investors if you want steady appreciation, and do noise checks for airports, highways, and logistics yards.

Buy smarter: prioritize well-drained lots outside mapped flood zones, efficient home envelopes with modern HVAC, zeroscape or drip irrigation yards, owner-occupied streets, and interior lots away from major noise sources. These choices reduce surprise costs and make a home more enjoyable every day.

If you want help running an address check or a quick relocation checklist for a PCS, I keep a few consult slots each week to help buyers run these filters fast. Run the checklist, ask for the documents, and don’t close on emotion alone. Your future self will thank you.

Categories

Recent Posts